Hanging by a thread: Somali families need to be able to send money home

Remittances to Somalia amount to approximately $1.3 billion a year, 16 percent of which comes from the United States. Photo: http://bit.ly/1skat6C

Remittances to Somalia amount to approximately $1.3 billion a year, 16 percent of which comes from the United States. Photo: http://bit.ly/1skat6C

A new paper examines the ongoing threat to Somalia’s remittance lifeline.

A joint guest post by Degan Ali, Executive Director of Adeso, and Ed Pomfret, Somalia campaigns and policy manager at Oxfam.

At a time where ‘resilience’ seems to be the new buzzword on the tip of everyone’s tongue, one of Somalia’s most resilient systems – remittances – is hanging by a thread.

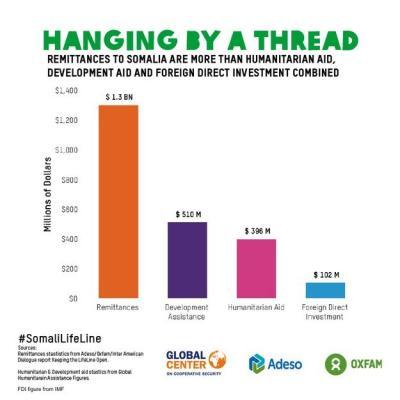

The money sent home to loved ones by Somalis living abroad makes up a huge proportion of the country’s economy – estimates put the figure at somewhere between 25% and 40%. Every year, Somalia receives approximately $1.3 billion in remittances, exceeding the amount it receives in humanitarian aid, development aid, and foreign direct investment combined. Nearly half of the population depends on remittances to meet their everyday needs. When people receive money, they spend it on essentials such as food, water, education, clothing, housing or medicine.

Today Adeso, the Global Center for Cooperative Security, and Oxfam release a new report “Hanging by a Thread: The ongoing threat to Somalia’s remittance lifeline” which outlines what has happened over the past year in the battle to save this lifeline.

In a country where close to three quarters of a million people are reliant on humanitarian aid for survival and where funding to deal with the crisis is always too little, these funds provide a lifeline on which millions of people depend.

But today, this flow of money is under threat like never before. Harsh counter terror and anti money-laundering regulations have pushed many banks to shut down the accounts of Somali money transfer operators (MTOs). Because of the lack of credible identification schemes and ongoing conflict Somalia is perceived as a high risk place in which to do business.

The shrinking lifeline

Two weeks ago, Merchants Bank of California, which handles between 60-80% of the money transferred from the USA to Somalia, shut down these accounts. This has led to many companies shutting their doors and some MTOs are now transferring money outside the banking system. Even if the remaining companies avoid account closures, with the few small banks left, this system could soon collapse.

Suhair Farah Ismail a mother of five interviewed for the report sums up why this is such an important issue, saying:

“This money is used to cover all our basic needs such as food, water, and school fees for my children. We are fully dependent on the money. Without it we would not survive. You need money for everything; even if I had a skill, I would need money to help me [capitalize on it].”

We cannot afford to be complacent, trusting that Somalis will find a way to send money to relatives back home. Instead, while long-term solutions are being worked out, the US Treasury needs to act urgently to put in place a stopgap measure to ensure the money keeps flowing. For example, it could create a special, temporary regulatory regime, including safe harbours for banks doing business with licensed and regulated Somali MTOs, or it could employ a public financial institution, such as the New York Federal Reserve Bank, to send money on behalf of the Somali MTOs until market conditions entice private banks to again offer accounts.

Remittances from elsewhere threatened as well

At the same time, we must not forget about Australia, where a similar situation is brewing as the one major bank that is still banking remittance companies recently announced it will close their bank accounts by end of March this year. The Australian government is following developments closely, but needs to ensure that contingency measures are put in place to address any disruption in the flow of remittances.

In the UK, where Barclays Bank closed the accounts of remittance companies last year, the UK Government has actually taken some forward looking steps by setting up a pilot project to try and secure the flow of money from the UK to Somalia. Although a good response to the crisis, implementation has been slower than expected and the situation in America and Australia highlights the urgency of action.

Remittances’ underlying structural problems

While governments overseas take steps to address the problem, this crisis also needs to be tackled in Somali territories. There is a need to urgently improve financial management and transparency, including strengthening Somali formal banking systems with the support of countries with major Somali populations.

As Hawa Abdullahi Warsame who lives in Badhan, Somalia, explains:

“People’s entire lives are dependent on these remittances, and until the day that Somalia can take care of its own people, we remain dependent on them.

“This is not just extra money: this is money that I need to survive on a daily basis.

“Not only am I dependent on it, but over ten relatives – my entire extended family – are as well. I have sick relatives who need medication, and children that I am trying to provide an education for. This money is vital for that. If I did not receive this money we would not be able to survive and I am scared to even think about what could happen.”

Somalia is at a crossroads, and if we truly want to support the country as it strives to rebuild itself, we should be doing everything in our power to support the most resilient system that exists in Somalia today, instead of dismantling the remittance system.