Why would an international tax lawyer join Oxfam?

"He never ceased to believe that a country so rich in natural resources, yet so poor deserved a better future." The countryside of eastern Democratic Republic of Congo. Photo: Eleanor Farmer / Oxfam

"He never ceased to believe that a country so rich in natural resources, yet so poor deserved a better future." The countryside of eastern Democratic Republic of Congo. Photo: Eleanor Farmer / Oxfam

A tax law expert’s personal journey from the private sector to the non-profit and advocacy world.

Tatu Ilunga is Senior Policy Advisor on Tax for Oxfam America’s Extractive Industries Team.

After years of practicing tax law with firms like KPMG and Ernst & Young, and working on Taxation in the EI and investment arbitration at the World Bank, I was looking for a change. I didn’t know exactly where I wanted to go next, but my first thought was that I wanted to finally find something that would allow me to make a valuable and direct contribution to people’s lives in my native Africa.

You might wonder, with a background in international taxation, how I got to the point where I would consider leaving behind structuring investments for multinational companies in a tax efficient manner to work for an NGO – I have indeed wondered myself. In my seven years in the private sector, where I was mostly interested in reducing effective tax rates for corporations and advising on deals that made headlines, I never thought my interests would ever fall on tax justice and inequality.

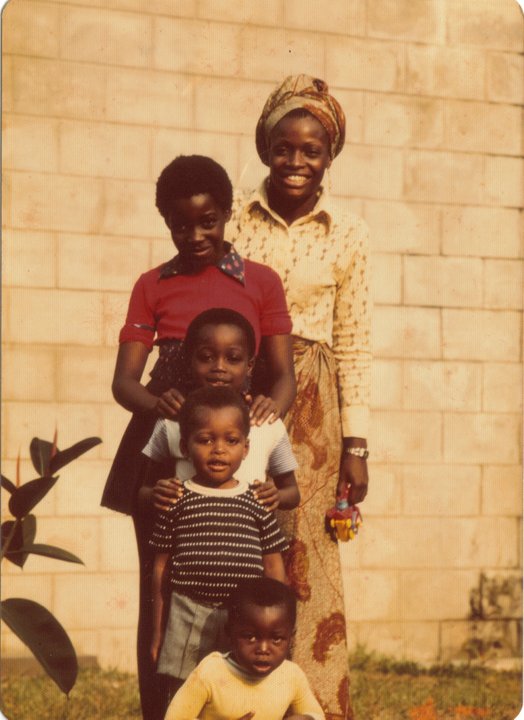

When I started my private sector career, I was miles away from believing that my family’s background and my father’s profession and activism would influence my own professional choices. My family is originally from the Democratic Republic of Congo (DRC), where I spent much of my early childhood. There, I watched my father – a graduate of UC Berkeley, professor of political science, and long-time civil servant – fight for democracy and equality in his beloved Congo. At the time, I really had nothing to worry about. We were a middle class family with a strong educational background; it was a good bet that I would have no problem becoming a medical doctor or business attorney with one of the country’s many international mining or telecom companies.

Political turmoil interrupted those dreams and took me and my family to Brussels, Belgium. There, I graduated from high school and had to make the big decision that many teenagers face: what I wanted to do with my life. Would I be the medical doctor my mom always talked about, the brilliant development economist my dad always said Africa so cruelly lacks, or the hard-hitting business lawyer I saw in so many Western TV shows throughout my childhood. As I’m sure you already guessed, to the great disappointment of my parents, I chose law school. I thought that as an attorney, I would have nothing to worry about – the money would be good so my family would be financially secure.

Though our life in Belgium was good – safe, financially stable – and though it was clear that nothing had changed for the better in Congo, home was never far from my father’s heart. He never ceased to believe that a country so rich in natural resources, yet so poor, deserved a better future. It was only right for the people of DRC to have a share of these resources, at the very least in the form of access to basic services like potable water, roads and schools.

My father’s passion stuck with me. And as I became more senior in my work in the private sector, I grew tired of seeing corporation after corporation save millions on taxes through “aggressive tax planning”, while millions of people in Africa and around the world didn’t have access to basic necessities. I began thinking about moving on to a job that would allow me to contribute to changing that dynamic for the people of Africa. Following my father’s death in exile in Belgium, I decided I could no longer wait and needed to commit to work for the greater good and help make the impact in Congo (and resource-rich but poor places like it) that my father didn’t have the chance to achieve in his lifetime.

My newfound commitment took me to Washington, DC where I enrolled in graduate school and eventually joined the World Bank’s International Center for the Settlement of Investment Disputes (ICSID), where I worked on settling disputes between countries and investors, with a particular focus on Africa. This was a step in the right direction. I felt that I was getting close to making the type of impact I was looking for because – depending on the outcome of the proceedings – countries might be compensated in a way that might bring benefits to their population. Yet, I wasn’t exactly where I wanted to be.

I was then lucky to join the World Bank’s Energy and Extractive Industries Global Practice, where I worked as a consultant helping African ministries of finance and mines address challenges in mining tax administration and revenue collection, while also maintaining attractiveness to investors. This felt right – finally, a chance to combine my expertise in international taxation and interest in seeing meaningful progress on the continent.

Upon completion of the consulting assignment, I began looking for opportunities that would keep me on the same track. Enter Oxfam America, where I found a posting for a Senior Policy Advisor for Tax and Extractive Industries. Given my experience and interest in international taxation and extractive industries, it seemed like a great fit. The advocacy side was new, of course, so I had my reservations, but I moved forward.

But again, it all came back to my desire to make a valuable contribution and direct impact to the lives of people in developing countries. I thought this might finally be my long-awaited chance to contributing to help fix the system by preventing multinational companies from dodging billions of dollars in taxes through profit shifting and other harmful tax tricks, to the great detriment of poor countries where they operate. I’m excited to be able to offer my tax expertise to the great civil society tax justice campaigns that are gaining steam – and public attention – every day.

Though it seemed unlikely at the start, the more I reflect, the more my path to being an international tax lawyer at Oxfam America comes together. Each step along the way has led me here – using my expertise and experience to provide policy analysis and to support Oxfam America’s tax justice agenda in oil, gas and mining – to ensure that countries are reaping the benefits of their own resources in a way that’s both legal and fair. And though it’s just the beginning, I’d like to think I’ve finally made it to a place where the work I do every day will help improve the lives for my fellow Africans for years to come.