Trains derailing, banks failing. These events are not accidents of nature. They happen when corporations and the ultrawealthy are allowed to behave recklessly with our lives and our world. Big business spent $3.5 billion last year in the effort to pressure Congress to get their way. Now we’re paying the price.

So far, 2023 has provided glaring examples of what happens when corporate power overreaches and puts real people in harm’s way. And by overreach, we mean—pressures Congress and the federal administration to loosen protective ties.

The truth is, it makes sense. It’s the logical end of a calculation that prioritizes short-term gain for a few—in the shape of profits, and shareholder returns, and executive compensation—at the expense of every other thing.

The bottom line of an unregulated system doesn’t value the lives and well-being of working families, the climate, or wildlife—all of which are at risk when disasters occur. It’s about power, and the lack of political will to stand up to it.

Big business is spending billions to pressure Congress and agencies, flying in the face of popular will

Corporate power now plays a vastly outsized role in determining public policy. The banking and railroad industries are not even the leaders in spending on lobbying efforts.

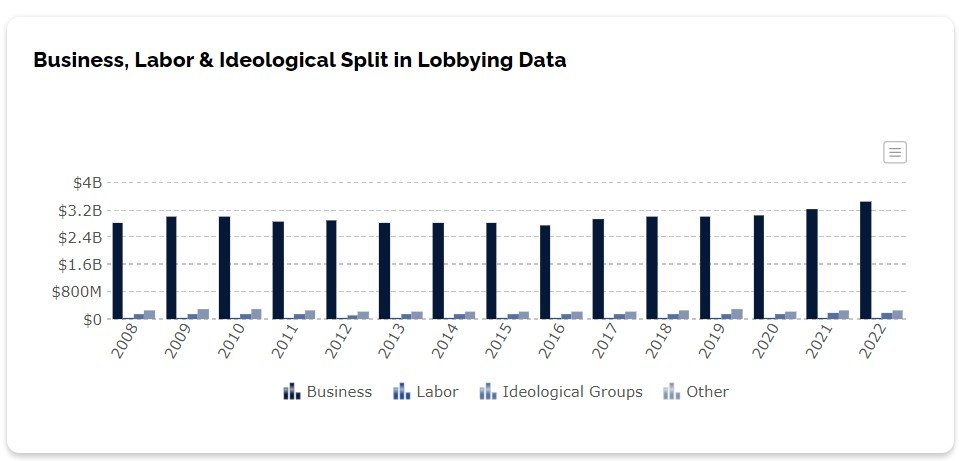

But it wasn’t always this way. Starting in the 1970s, companies realized the benefit of investing in lobbying as a way to pressure Congress. In the early 2000s, money spent on corporate lobbying began to exceed the money spent on Congress (combined budget for the House and the Senate). In 2022, it ballooned to $3.5 billion per year.

Business now accounts for 87% of all lobbying dollars. Of the 100 organizations that spend the most on lobbying, 95 consistently represent business.

- In 2021, we watched as corporations poured millions into a lobbying blitz to stop Congress from passing President Biden’s economic agenda.

- Last year, pharmaceutical and health product companies poured a record $372 million into lobbying. The trade association Pharmaceutical Research & Manufacturers of America (PhRMA) was the top individual lobbying spender in the industry in 2022, at $29.2 million.

- Every year, companies and business groups spend millions on efforts to discourage increases in the federal minimum wage, as well as the tipped wage. Among the organizations: the National Restaurant Association, American Legislative Exchange Council (ALEC), the U.S. Chamber of Commerce and the National Right to Work Committee.

The increase in money has also signaled a shift in what big business expects from Congress. As Lee Drutman, the author of the book The Business of America is Lobbying, notes, lobbying “has fundamentally changed how corporations interact with government—rather than trying to keep government out of its business (as they did for a long time), companies are now increasingly bringing government in as a partner, looking to see what the country can do for them.”

Moreover, this much money and power is warping the political landscape away from measures that are enormously popular with the people. Polls consistently show wide margins of approval for progressive measures like raising the minimum wage, drug pricing reform, common sense gun safety reforms, and raising taxes on the ultrawealthy and corporations that offshore profits and jobs. And the list goes on.

How is it possible for a major bank to fail today?

It shouldn’t be. We should have learned our lessons not just from the Great Depression, but from still-resonating sting of the 2008 financial crisis.

In 1933, Congress created the Glass-Steagall Act, which created the Federal Deposit Insurance Corporation (FDIC). After the 2008 crisis, Congress found a backbone and passed the Dodd-Frank Wall Street Reform and Consumer Protection Act to put guardrails on big banks--despite ferocious lobbying by Wall Street executives, lobbyists, and lawyers.

However, less than ten years later, In 2018, the banks won a concession, with a law that rolled back critical parts of Dodd-Frank. At the time, Sen. Elizabeth Warren sounded the alarm: “Washington is about to make it easier for the banks to run up risk, make it easier to put our constituents at risk, make it easier to put American families in danger, just so the CEOs of these banks can get a new corporate jet and add another floor to their new corporate headquarters.”

And then, sure enough, it happened in 2023. This week, in an opinion piece in the New York Times, she noted: “These recent bank failures are the direct result of leaders in Washington weakening the financial rules.”

What compels Congress to take the reins off? Power, and money.

And then what saves the system and the people behind the banks? Federal action. Recently, the FDIC stepped in set up intermediary banks to take over two banks’ insured deposits.

Which is wise, and healthy—but is reactive to a disaster, rather than proactive.

Why it matters for inequality: Saving the banks disproportionately benefits the banks and the wealthy. On the other hand, despite many efforts, the first $10,000 of student loan debt has yet to be forgiven; and THIS move would disproportionately benefit people in low-wage jobs and BIPOC people, and help narrow the racial wealth gap. Of the populations that would be free of debt after such a move, it would be American Indian or Alaska Native borrowers at 66 percent, Hispanic borrowers at 61 percent, and Black borrowers at 56 percent.

How is it possible for trains carrying deadly chemicals to fall off the rails in residential areas?

When the 150-car train carrying hazardous material derailed in East Palestine, Ohio on February 3, it kicked off a series of environmental catastrophes, including a massive fire that lasted for days, and spills of dangerous chemicals into soil and water. It was almost certainly a direct result of companies lobbying for lax rules and implementing riskier practices.

We won’t know the full extent of damage—to people, animals, natural resources—for years, if not generations.

And it’s not an isolated incident: days later, a train crashed near Houston, and another derailed outside of Detroit.

Given the potential for such enormous devastation, how did we lose grip on the controls that keep transit of hazardous chemicals safe? The answer, to no one’s surprise, has to do with corporate power, and the relentless pursuit of profit above all.

“[Disasters like this are] going to keep happening if regulators continue to allow this business model to ravage our nation’s freight rail system in the pursuit of profit. My fear is that these corporations have so much money and political influence that nothing is going to change.” –Rail Worker as quoted in Motherboard

Railroad companies have become somewhat notorious lately for their refusal to provide paid leave for workers; but their efforts to maximize profits don’t stop there. At least one company recently paid out billions in stock buybacks while simultaneously laying off a big chunk of the workforce.

One company was outspoken about the value of “precision scheduled railroading” (PSR), which includes centralizing operations, reducing staff, running fewer, heavier, faster trains and optimizing the network; in its words, to “focus more on lengthening trains and increasing train weights as a way to keep costs down and increase network productivity.” All of these steps fly in the face of rigorous safety measures, and likely contributed to the accident in East Palestine.

Moreover, railroad companies have actively conducted a lobbying blitz against stronger transportation safety regulations. During the Obama administration, a rule was passed that required trains carrying hazardous flammable materials to have Electronically Controlled Pneumatic (ECP), a significant upgrade from a braking system first developed in 1868. Trains equipped with traditional air brakes make emergency stops more slowly and with higher rates of damage than trains equipped with ECP brakes.

Then, in 2017, the Trump administration—under pressure from rail lobbyists and Senate Republicans—rescinded part of that rule. The freight train in East Palestine was not equipped with ECP brakes.

Fettered is better

The reality is that corporate power has grown to a monstrous size, and has an outsize influence on lawmakers. The decisions that benefit corporations rarely if ever benefit the rest of us; and often exacerbate structural inequities on the lines of race, class, and gender.

Rules and regulations may be burdensome to some, but they perform essential functions in safeguarding people, wildlife, the climate—and more.