As millions in corporate cash and armies of lobbyists flood the Capitol, Congress is poised yet again to favor corporations and the wealthy over investments in working families and the climate.

As the West Coast burns, the East Coast floods, and the Delta variant ravages the entire country, Americans are clear on what they want: equity, shared prosperity, and a healthy future.

Three quarters of voters support President Biden’s Build Back Better infrastructure plan, with its investments in, among other things, child care, paid leave, and Medicare benefits, as well as clean energy and protections from climate disasters. This moment is our best chance in decades to address structural racism, the climate crisis, radical inequality, gender inequities—and more.

Just as importantly, two-thirds of Americans support higher taxes on corporations to pay for it.

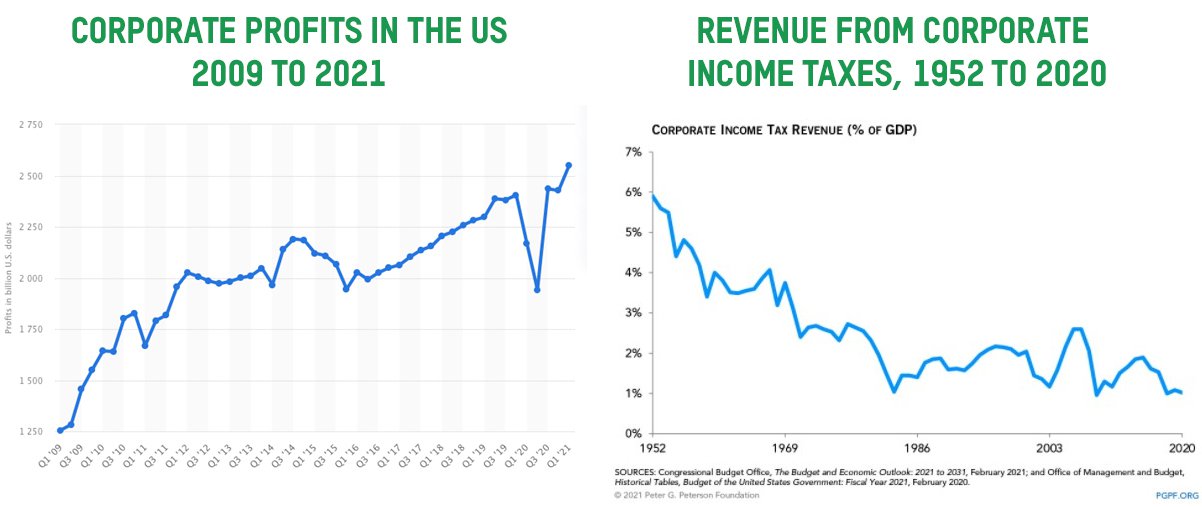

The math is simple: corporate profits are way up, and billionaires are amassing more wealth every day (see charts)—while corporate tax payments are way down. Since the start of the pandemic, Jeff Bezos’ wealth went from $113b to $200b; Elon Musk’s went from $25b to $200b; Bill Gates’s went from $98b to $151b… overall, billionaires’ wealth rose by 62%, from $2.9t to $4.8t. Corporate profits soared in the second quarter of 2021, to a record $2.8 trillion.

While the ultra-wealthy are playing wild games with their excess money—engaging in space races and buying up private islands—millions of kids need early education, teachers turn to crowdfunding for basic supplies, and many elderly can’t afford eyeglasses or hearing aids. And our country is, quite literally, on fire and under water.

So while the price tag on the budget bill may seem high at $3.5 trillion (over ten years)—it pales in comparison to the heights in our economy as a whole. We remain the wealthiest country in the history of the world, plagued by persistent and worsening inequality, and staring down climate catastrophe.

Yet a handful of corporations and billionaires are also clear on what they want—and that is more of the same they have negotiated over decades: offshore tax havens, loopholes, subsidies, and egregiously low tax rates. And skyrocketing wealth and profits.

And that side is mobilizing for all-out war, in a blitz of lobbying efforts to get the ear, and the vote, of many Members of Congress. It’s widely reported that they are mounting an “overwhelming corporate lobbying barrage”; a senior VP at the National Association of Manufacturers notes that “We’re doing it in every way you can imagine.”

It’s a roll call of familiar corporations behind this barrage, including many of the country’s biggest corporations, the U.S. Chamber of Commerce, the Business Roundtable, and a group representing pharmaceutical giants. After winning a massive reduction in corporate taxes in 2017 (from 35% to 21%), they’re doubling down on preventing a reversal—even though it’s clear the 2017 change was harmful to the economy overall, and to working families especially.

We’ve seen this movie before. In the run-up to the passage of the Trump tax cuts in 2017, giant companies—including Pfizer, Walgreen’s, Archer Daniels Midland, Google, Exxon, JP Morgan, and Nike—garnered attention for speaking out against President Trump’s policies and rhetoric in the first year of his presidency; but when it came to flexing their lobbying muscle, the same companies mostly put their money behind advocating for lower taxes, which paid off handsomely.

The rich are trying to block desperately needed investments in America just because they don’t want to pay their fair share in taxes.

Right now, we have an opportunity to make new choices: to address the climate crisis head on (by investing in clean energy and ending fossil fuel subsidies); to support working families (by mandating paid sick and family leave and supporting early childhood education); to make healthcare more accessible (by expanding Medicare benefits).

The sides in this fight couldn’t be more clear—on the one side you have the vast majority of the American people, and on the other just a handful of billionaires and multinational corporations. Yet this is a fight that we are in danger of losing.

We need to tell Congress now to prioritize people over corporate profits. Join us in reaching out to Congress to demand that corporations and billionaires pay their fair share. It’s not just right, it’s about our future.

Tax the rich: It’s not that hard

While the wealthy spent decades tinkering with a tax system that enables them to skirt paying their fair share, we can take steps to rebuild and reorient the system. The pieces are on the table, we just need to reassemble them.

Among the most fundamental steps:

- increase the corporate tax rate to 28% (still lower than it was before the 2017 tax cuts),

- end tax subsidies for offshoring jobs,

- fix the loophole that allows billionaires to pass on their wealth to their heirs tax-free,

- end the carried interest loophole,

- pass a tax on billionaires’ wealth,

- increase funding for the IRS to enforce the tax code and collect from tax evaders,

- end fossil fuel subsidies for oil and gas companies,

- tax returns to capital the same as returns to labor.

As our economy inches toward recovery, it’s time to demand that the federal government step up and raise the bar for all workers in the US. Take action.