Billionaires don’t pay their fair share in taxes. There is no justification for it. We must tax them now to invest in our families and a green economy.

Deep in January of most years, the global elite gathers at a ski resort in Davos, Switzerland, and engages in networking, sharing and shaping ideas and beliefs. (In 2021 and 2022, the meetings have been virtual.)

And while the world’s wealthiest and most famous chat, Oxfam presents its counter-narrative decrying the excesses of economic inequality.

This year’s Oxfam report is titled Inequality Kills, and explores the idea of "economic violence." Elsewhere, I explore the numbers behind this idea; here, I focus on one key recommendation of the report: countries should resolutely move to adopt wealth taxes, especially on the richest.

Billionaires don’t pay their fair share

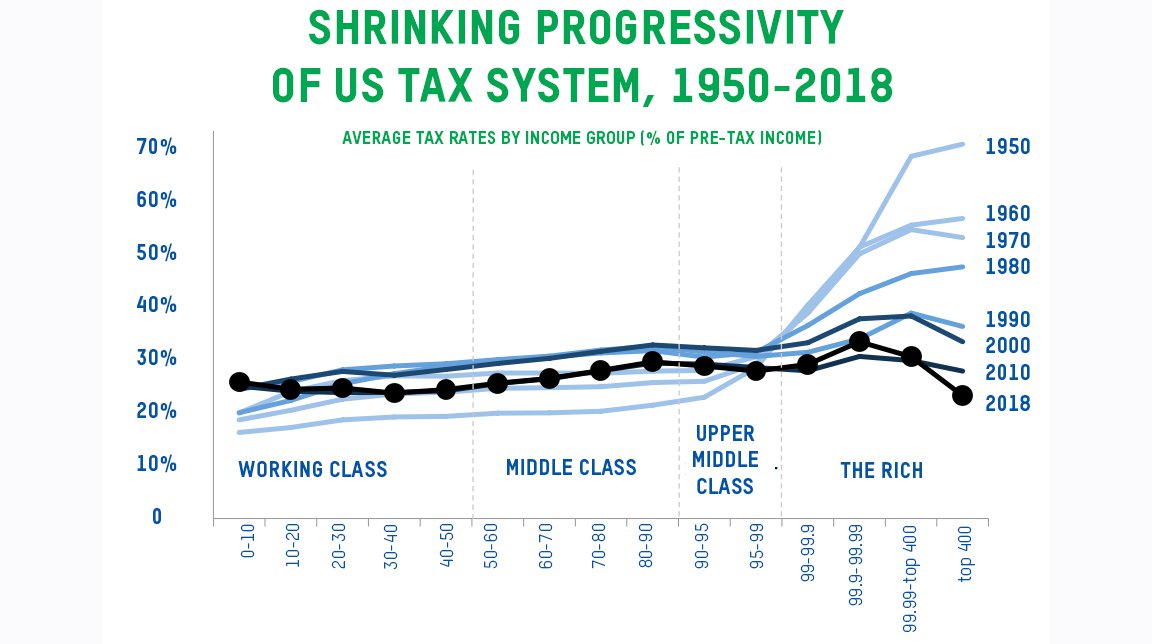

If you have the gut feeling that “the rich don’t pay their fair share of taxes,” you are spot on. And it’s getting worse. The graph below shows the evolution of the “progressivity” of the tax system (i.e., the degree to which all taxes redistribute income).

This graph illustrates how the tax rate has become dramatically less progressive over the past 70 years. The lines indicate tax rates (taxes divided by income) for those earning the lowest incomes to the highest incomes (from left to right). In previous decades, richer Americans clearly paid much higher tax rates; now the line (in black) is essentially flat (ie, all Americans pay about the same rate)–except that the highest earners pay the lowest tax rate.

The Biden administration has confirmed this: the richest 400 American taxpayers paid a federal income tax rate of only 8% when the increase in their wealth is counted as income, compared to the average taxpayer’s rate of 14%. Based on leaked tax returns, investigative journalists revealed that the 25 richest Americans paid even less between 2014 and 2018; some paid no tax at all.

That is possible because of the “billionaires’ loophole”: under current law, increases in wealth (or “capital gains”) are counted as taxable income only when they are “realized” (i.e., when the assets are sold). So, if the main asset of a person takes the form of shares of the companies he created, he (billionaires are mostly men) doesn’t owe any tax as long as he holds onto these shares. (He can also easily transfer these shares tax-free to his heirs thanks to another loophole.)

There is no justification for it

If your gut also tells you that billionaires don’t deserve their wealth (and certainly don’t deserve a tax break), your gut is again right. Extreme wealth is not the product of the laws of nature. It is the unnecessary byproduct of man-made laws. I thoroughly deconstruct the meritocracy myth in another piece (or here for a shorter version). A lot of billionaire wealth (three quarters, by one estimate) is simply not the product of talent and effort.

In the idealized competitive economy of economics textbooks, extreme wealth does not exist; as soon as extraordinary profits are made in one market, competitors ought to rush in to get a piece of the action, and this drives prices and hence profits back down. But in the real world such market responses take time and can be thwarted by government action or inaction. Monopolies thrive and entrench their power.

Far from being a sign of economic strength, billionaire wealth is a sign of economic policy failure. Taxing billionaires is therefore unlikely to affect the growth or jobs creation of the successful corporations that they created.

We must tax billionaires now to invest in our families and a green economy

This issue is particularly relevant to the United States right now. Congress is debating President Biden’s plan to invest in social protection and in the fight against climate change (the “Build Back Better Act”). It is entirely paid for by taxes on the rich and corporations. Oddly, though, the very richest might be left off the hook because of the billionaire loophole.

Congress should not only pass Build Back Better, but also include the Billionaires Income Tax among its provisions. That proposal directly addresses the billionaires’ loophole by taxing billionaires’ wealth increases on an annual basis.

Make no mistake, these changes are urgently needed, and only the beginning. As the global pandemic rages on, it aggravates inequality; those on the margins are feeling the dangerous impacts of unemployment, inflation, evictions, at the very same time that billionaires are reaping enormous pandemic profits.

We can build a more equal, healthier, and greener economy—and we can easily fund it, today, including by ensuring billionaires pay their fair share.

______________________________________________

Take action now: Demand that we tax the rich.