Tax Day raises questions about how our tax system works–and who exactly it works for. This year, Oxfam underscores the urgent need not just for progressive income and corporate taxes, but for a federal wealth tax. So many reasons why…

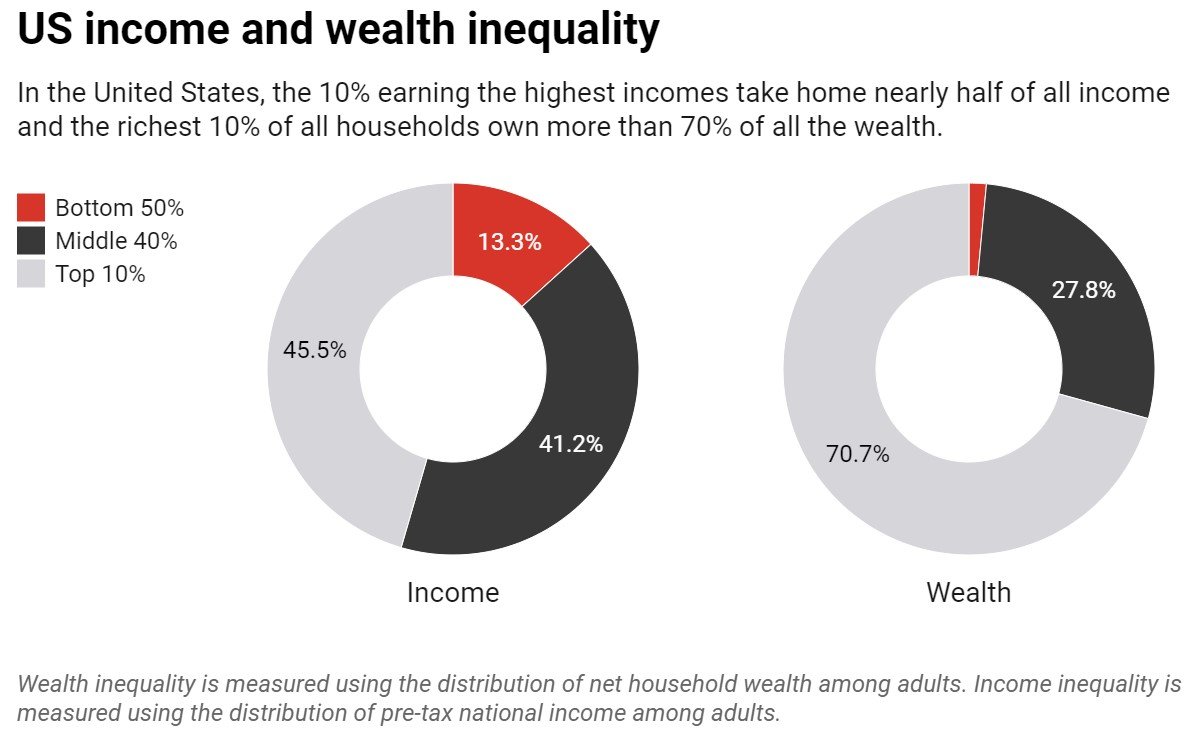

Simply, it is well past time for a tax on extreme wealth. Wealth inequality in the US is more severe and dangerous than income inequality; and it’s urgent to effectively tax wealth as well as income.

At a time when the ultrawealthy are amassing historic and dangerous levels of wealth, a federal wealth tax offers a vital and necessary tool for directly redressing extreme wealth inequality, as well as advancing racial justice, tackling the climate crisis, and protecting democracy. It also offers a reminder that today’s debt-ceiling gridlock is a consequence of giving tax breaks to the ultrawealthy.

For more about extreme inequality and the need for a wealth tax, please refer to Oxfam’s new brief, Tax wealth, tackle inequality.

Why tax extreme wealth? Five excellent reasons (to start)

1. Reduce inequality. Full stop.

Taxing extreme wealth immediately reduces that wealth concentration, and lowers the stratospheric level it has reached. Then we can invest that revenue in programs that support working families and those with little or no wealth.

- Updated estimates for the wealth tax proposed by Senator Warren, based on taxing US billionaires alone, would raise $114 billion annually. Taxing all wealth above the proposed lower threshold above $50 million would increase this number substantially.*

- An annual net wealth tax could raise over half a trillion dollars ($582.6 billion) each year, by taxing more than only billionaires and using marginally higher rates: 2% for wealth above $5 million, 3% above $50 million, and 5% above $1 billion. (Calculations from Oxfam, Patriotic Millionaires, and the Institute for Policy Studies.)

These new taxes provide sorely needed revenue to invest in programs that support working families.

- Reinstate the expanded Child Tax Credit: $97 billion

It’s urgent that we bring back this benefit that reached 61.2 million children and cut child poverty by an astonishing 30 percent during the height of the pandemic–lifting 3 million children out of poverty. - Invest in child care and families: $24 billion

We can make child care affordable for all families with children from birth through age 5 using a sliding scale for copayments, and raise wages for the early childhood workforce, helping to address the crisis of care in the US and the gender inequality that it deepens. - Provide paid family and medical leave: $22.5 billion

We can ensure workers will receive partial wage replacement for up to twelve weeks of parental, family, and/or personal illness leave. Over 60% of low-wage workers do not have access to any paid leave, including sick leave.

2. Narrow the racial wealth gap, and the gender wealth gap

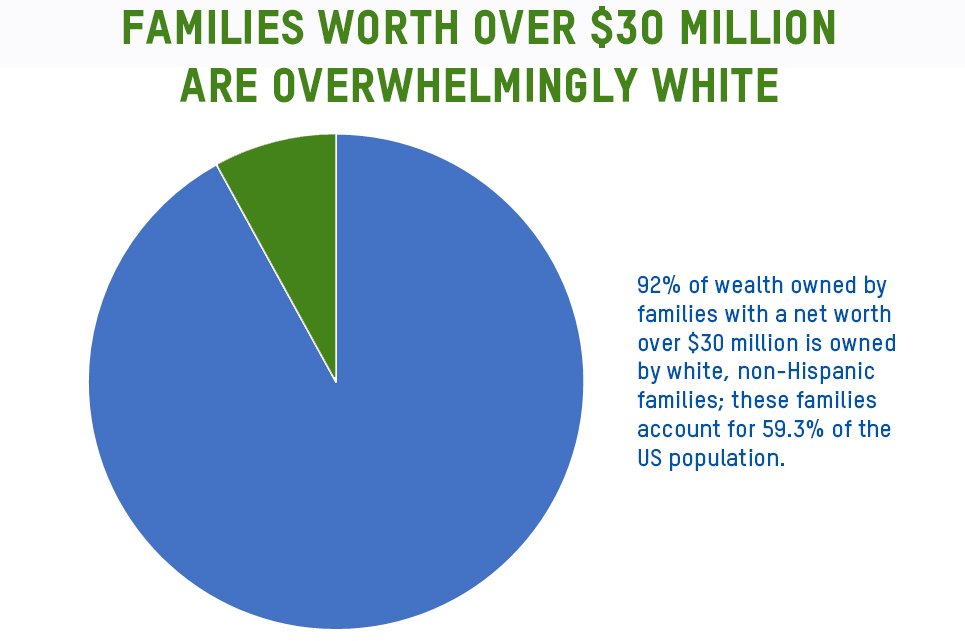

Today’s racial wealth gap – which has widened recently to the same level as in 1950 – is directly related to a racist past in the US that begins with white Americans enslaving Black people and treating them as capital itself (including as collateral for loans). This evolved into a system in which Black people were systematically excluded from accumulating wealth.

The gap is a direct result of such history and policy, that echoes today from blocks in access to finance, predatory financing (particularly in home ownership), and the trap of low-wage employment. Dorothy Brown has shown how today’s tax code also perpetuates the racial wealth gap.

The average Black American household currently has only about 12 cents in wealth for every dollar of the average white American household.

Taxing extreme wealth would immediately reduce the extreme concentration of wealth at the very top, which is almost exclusively held by white households. And that’s before we deploy new revenues in transformative investments for greater economic and racial equality, like Baby Bonds.

The gender wealth gap is much more severe than the gender income gap. While this gap is more difficult to measure (on a household basis), one study found a raw gender wealth gap of women owning 32 cents for every dollar of male wealth. For women of color, the gap is even more profound.

Certainly at the top, a vast proportion of multi-millionaires and billionaires are male; the proportion of women billionaires is about 10 percent.

So, again, a tax on the ultrawealthy would help to reduce the gender wealth gap; and provide resources for investing in programs which would support women’s ability to participate in paid work.

3. Tackle the climate crisis

The climate crisis is disproportionately driven by the investments and the emissions of the wealthiest people. Personally, they engage in wasteful consumption (think private jets); but more importantly, they choose to invest in polluting industries—more than twice the average for investments in the Standard and Poor 500.

Fiscal policy can play a role in reducing harmful emissions, and in generating revenues for climate financing.

- Support lower-income countries to address the climate crisis: $80 billion

Lower-income countries need assistance to deal with the catastrophic consequences of climate disasters caused by carbon pollution from richer countries like the US as a matter of justice. - Provide subsidies and infrastructure so that families can meet their needs with renewable energy: $200 billion

The US should be providing subsidies and the necessary infrastructure so that people can switch their homes from gas to electricity, install solar panels, access affordable public transport, and buy electric vehicles if they need them.

4. Avoid increasing the federal debt (and the debt-ceiling gridlock)

Today’s political gridlock around the debt ceiling was avoidable, and is a direct consequence of tax cuts on the wealthiest and corporations. The Center for American Progress reports that today’s increasing debt ratio is primarily a result of recent tax cuts for the wealthiest: tax cuts since 2001 have added $10 trillion to the debt, and are responsible for over half the increase in debt ratio since then.

5. Save democracy

By combating wealth concentration, wealth taxes can curb the influence of a super-wealthy elite over politics, markets, and the media.

The ultrawealthy and corporations now play a vastly outsized role in determining public policy in this country. By 2022, corporate lobbying had ballooned to $3.5 billion per year, and now accounts for 87% of all lobbying dollars. Much of this lobbying is done to bend public policy to their own economic interests. This is a fundamental reason why corporate profit and billionaire wealth has been enabled to soar to new heights: tax cuts for the ultrawealthy, no reins on stock buybacks, no raise in federal minimum wages. In 2021, many corporations poured millions into a lobbying blitz to stop Congress from passing President Biden’s economic agenda.

This power is warping the political landscape away from measures that are enormously popular with people. Polls consistently show wide margins of approval for progressive measures like raising the minimum wage, drug pricing reform, action to tackle climate breakdown, and raising taxes on the ultrawealthy and corporations.

Our public and economic policies have enabled the ultrawealthy and corporations to amass so much wealth that it has become a threat to our democracy, our prosperity, and our health as a society. But we have a solution in our hands: Tax extreme wealth. And invest in the building blocks of a better future.

___________________________________________

Please take action: Sign the petition. Read the full brief.

*For a full explanation of the methodology behind our numbers, please refer to Tax wealth, tackle inequality.